Quick Links

Favorites

Customize ESPN

ESPN Sites

ESPN Apps

Arsenal highlight everything that is wrong with Pochettino's Chelsea

Arsenal's 5-0 win over Chelsea not only demonstrated how serious the Gunners are on their quest to win the Premier League, but also how different they are compared to their London rivals.

Burley: Arsenal absolutely wiped the floor with Chelsea

TOP HEADLINES

GLOBAL SOCCER SCOREBOARD

TUESDAY'S GAMES

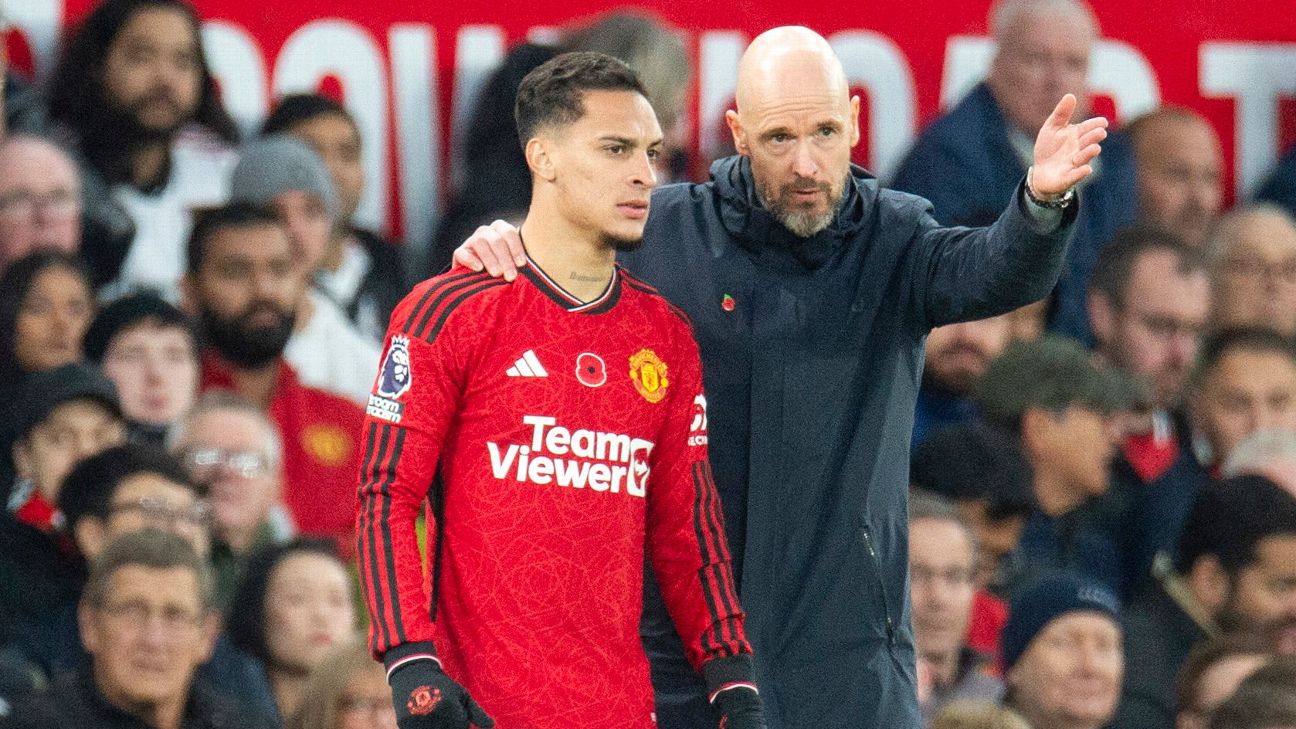

ASSESSING MAN UNITED'S MOVES

When big spending falls flat: Ranking all 16 Man United player moves under Erik ten Hag

Man United spent more on players than all but two clubs in the world under Ten Hag, but the team still isn't good. Let's go through all 16 signings to figure out why.

ENGLISH LEAGUE CHAMPIONSHIP

Vardy scores as Leicester thrash Southampton for huge win

WILL HE STAY OR WILL HE GO?

Is there a chance Xavi stays at Barcelona? Don't count it out

Barcelona have had an impressive run of form since Xavi announced he would be leaving, but is there a chance that the club and manager find a way to continue together?

Should Xavi Hernandez stay at Barcelona?

SOCCER TRANSFERS

LIVE Transfer Talk: Arsenal, Man City to battle for Bruno Guimarães

Man City and Arsenal are interested in signing Newcastle midfielder Bruno Guimarães, according to reports. Transfer Talk has the latest.

FROM YOUTH CAMP TO THE NATIONAL TEAM

Pulisic & McKennie reminisce about childhood memories together

MAKING WAVES IN EUROPE

European Team of the Week: Goretzka, Gakpo, Olise impress

ESPN and WhoScored bring you the best players from Europe's top five leagues from the latest round of action.

MARCOTTI'S MUSINGS

Madrid's depth (again) too much for Barca, Man United's nervy win, more

Real Madrid's athleticism and depth again made the difference against Barcelona. Plus: Why Man United's win over Coventry feels like a defeat, as Gab Marcotti recaps the weekend.

Top Headlines

- Sources: Ten Hag faces pay cut if he stays at Utd

- Poch defends Chelsea for giving up in Arsenal loss

- PSG on cusp of Ligue 1 title before Lorient clash

- Source: WCup winner Giroud signs deal with LAFC

- Sources: Liverpool consider Slot to replace Klopp

- Weah sets up decider as Juve reach Coppa final

- Injury-hit Miami signs Paraguay midfielder Rojas

- Wrexham star teases cameo in new Deadpool film

- Can Barca ever catch up to Real Madrid?

Best of ESPN+

Peter Byrne/PA Images via Getty Images Is Liverpool's Premier League, Europa League quest over?

It has been a tough week for Liverpool, with critical losses wrecking hopes of a treble. How did they get here, and is there a way back?

Illustration by ESPN Bellingham, Wirtz, Musiala lead best male soccer players U21

For the sixth straight year, ESPN brings you our list of the game's next top young stars aged 21 or under. Who is good enough to make it?

Trending Now

Colin McPherson/Corbis via Getty Images Football's climate change threat: Flooded stadiums, too hot to train

One in four stadiums in England are predicted to experience flooding by 2050. What is soccer's environmental impact and what can be done to reduce it?

Donald Page/Getty Images Messi tracker: Inter Miami games, goals, assists, more stats

Lionel Messi is in first full season with MLS side Inter Miami. Here's game-by-game analysis of how the World Cup winner is performing for his team.

Tables, fixtures and scores

Photo by James Gill - Danehouse/Getty Images League tables

Updated tables from the Premier League, Champions League, LaLiga, English Football League and more.

Photo by Andrew Kearns - CameraSport via Getty Images Upcoming fixtures

Keep track of all the important upcoming fixtures for all the clubs and countries in world football here.

Guillermo Martinez/SOPA Images/LightRocket via Getty Images Latest scores

Results and scores from the Premier League, Champions League, LaLiga, English Football League and more.