Quick Links

Favorites

Customize ESPN

ESPN Sites

ESPN Apps

Liverpool ratings: Salah gets 6/10 in elimination to Atalanta

Mohamed Salah was able to get his goal but Liverpool wasn't able to do enough as they were eliminated from the Europa League at the hands of Atalanta.

Can Liverpool salvage their season after Europa League exit?

TOP HEADLINES

SETTING THE TREND

How Olivia Moultrie paved the way for NWSL's youth movement

Olivia Moultrie is only in the NWSL because she sued for her right to play. Now, she's making her case to represent the USWNT at the Olympics.

How to stop Bellingham? 'You have almost no chance,' say LaLiga players, coaches

What do other players and opposing coaches think of the Real Madrid midfielder? What are his strengths and weaknesses? Jude Bellingham's rivals lift the lid on the Bernabeu's new icon.

'He's made it look easy!' - McManaman on Bellingham's first season in Madrid

UEFA EUROPA LEAGUE SCOREBOARD

THURSDAY'S GAMES

WHAT DID WE LEARN?

UCL talking points: Are PSG a team now? How will Arsenal, City react in title race?

With the four Champions League semifinalists now set, Gab Marcotti, Mark Ogden and Julien Laurens give their takes on the quarterfinal matches.

Would missing out on an extra UCL spot be a bad look for the Premier League?

SOCCER TRANSFERS

Transfer Talk: Arsenal will look to get both Isak, Olise

Arsenal will be looking to sign both Alexander Isak and Michael Olise in the summer transfer window. Transfer Talk has the latest.

MADRID, BAYERN MOVE ON

Real Madrid punish Man City's missed chances in Champions League epic clash

Man City are one of the world's elite teams, but Real Madrid showed why they are still the gold standard after a backs-against-the-wall win in the Champions League quarterfinals.

Bayern give inexperienced Arsenal a painful Champions League lesson

Arsenal's lack of know-how in the Champions League cost them against Bayern Munich.

'NEVERKUSEN' NO MORE

How Bayer Leverkusen built the team that took down Bayern. Can they do it again?

Bayer Leverkusen shocked perennial champions Bayern to win the Bundesliga at a canter, unbeaten so far, but how did they do it? And can they do so again?

Nicol unsure if Leverkusen can remain unbeaten in treble quest

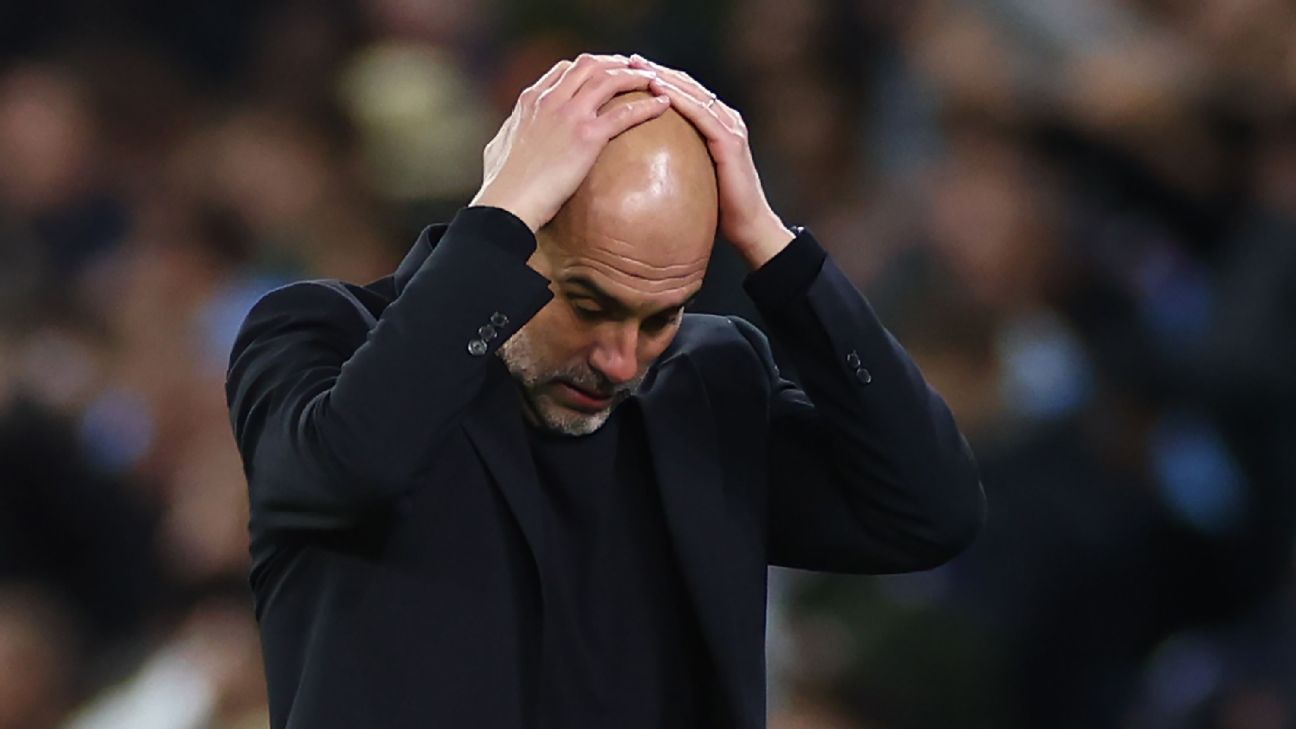

NO BACK-TO-BACK FOR MAN CITY

Man City's 'double-treble' dream is over, but 'worst week of season' is not

There's still plenty for Man City to play for this season, starting with Saturday's FA Cup semifinal, but their shot at football immortality is over.

Top Headlines

- Villa's Martínez breaks French hearts in PKs again

- Guzmán given 11-game ban due to laser incident

- Liverpool comeback falls short as Atalanta make SF

- Fan group claims 'aggression' in Barça pat downs

- Bayer rally puts streak at 44, on to Europa semis

- Schweinsteiger explains Utd exile under Mourinho

- Serie A secures extra place in Champions League

- Araújo ignores Gündogan criticism after red card

- Is Liverpool's quest for the treble over?

Best of ESPN+

Stuart MacFarlane/Arsenal FC via Getty Images Why this might be the best Arsenal team you've ever seen

The Invincibles might be the most important Premier League team of all time, but the current version of Arsenal might be even better.

Illustration by ESPN Bellingham, Wirtz, Musiala lead best male soccer players U21

For the sixth straight year, ESPN brings you our list of the game's next top young stars aged 21 or under. Who is good enough to make it?

Trending Now

Vincent Carchietta-USA TODAY Sports MLS Power Rankings: Red Bulls stay top, Philly Union No. 2

The New York Red Bulls held onto top spot with a draw vs. Chicago, while Philadelphia remains the league's only unbeaten team after a comeback in Atlanta.

(Photo by Ira L. Black - Corbis/Getty Images) NWSL Power Rankings: KC stays unbeaten as Marta helps Pride soar

Marta delivered a super-sub performance to help Orlando Pride surge in our NWSL Power Rankings. Meanwhile, who can stop Kansas City Current?

Donald Page/Getty Images Messi tracker: Inter Miami games, goals, assists, more stats

Lionel Messi is in first full season with MLS side Inter Miami. Here's game-by-game analysis of how the World Cup winner is performing for his team.

Tables, fixtures and scores

Photo by James Gill - Danehouse/Getty Images League tables

Updated tables from the Premier League, Champions League, LaLiga, English Football League and more.

Photo by Andrew Kearns - CameraSport via Getty Images Upcoming fixtures

Keep track of all the important upcoming fixtures for all the clubs and countries in world football here.

Guillermo Martinez/SOPA Images/LightRocket via Getty Images Latest scores

Results and scores from the Premier League, Champions League, LaLiga, English Football League and more.